If you’re a stock enthusiast, or a gamer or a casual Reddit browser, or all of these, you’ve probably come across GameStop (GME) stock. The Texas-based video game retailer has had a roller coaster first few weeks of the new year but is still far from knowing why its market capitalization is causing the stock to surge.

Anyone who knows the financial markets and capital investments is well aware of the these work and risks associated with it. In a general trade of buy-and-sell, it’s a simple trade, however, the risk amplifies if you’re betting against the stock, i.e., short selling.

The complexity of a reverse trade is simple to understand but tough to tackle. In a short-sell, you’re assuming the stock would dip to further lows thereby selling them at the market price to buy them back at a later stage when the prices are down.

All of this is lead by an assumption that the company you’re short-selling against, doesn’t fit the market per se. GameStop’s short selling position by several investment funds isn’t technically incorrect. The pandemic forced most retail stores to shut, and the gaming space is poised to be digital with time. No points to guess who takes the hit when stores move online, the local stores, in this case, i.e. GameStop.

Short sellers bet heavily on a stock to fall, further, dismantling their position in the market. These are not petty investors, these are mutual funds, hedgers, investment banks and other financial giants. Thus, the investment values and the open positions are often in millions if not billions.

The hedge funds and capital investment funds often make heavy trades, thereby, influencing the price of stocks in the market, where retail investors moreorless face the brunt of it. It is mostly that the retail investors dance at the tune of larger financial institutions. That’s what changed this time.

For instance, a $63 stock can be sold today and be purchased at a later date for $20 in case the fundamentals reflect that ordeal. The problem in short-selling is the avenue of loss potential. You’re basically opting for infinite losses in case of the stock price rises. The ones who opt for short stocks are often referred to as bears (bulls are referred to investors with positive sentiments) in financial markets and they generally do make pretty well in times of distress.

Well, that’s at least what Melvin Capital & Citron Research had thought. The bears have lost $5 billion off the GameStop stock. FIVE BILLION.

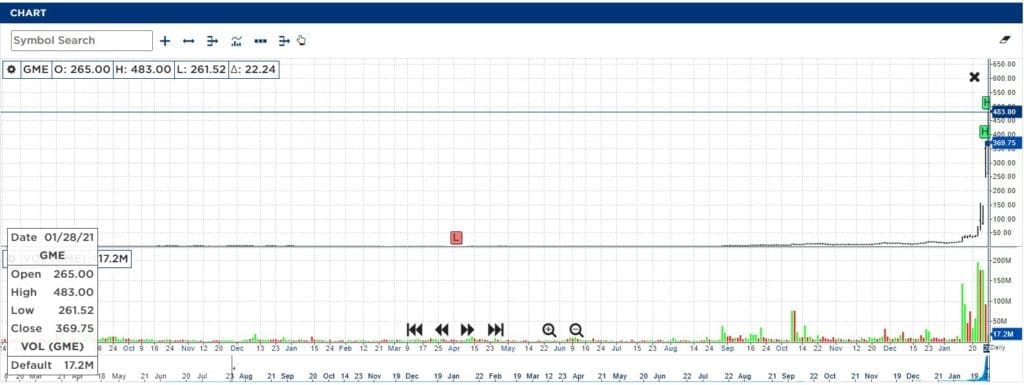

Wolf of Wall Street’s Wild Ride Takes Stock To Highs of $483

If you were too cautious to trade in cryptocurrency and bitcoins, wait until you see The GameStop Drag. Today, the prices of GameStop have breached all levels and hit a high of$483. The price of the stock was $20 in the first week of January this year. The wild run of GME has no justification whatsoever, as it may seem, it is based on anger and furiosity against the investment funds of New York, some say.

The stock is currently trading at its week’s low $126, down 63%.

Defying The Rules Of The Trade

In the current debacle, at least for the suits at New York, Reddit users at WallStreetBets decided to take on the big horses. A group of retail stock investors decided to buy GameStop stock, despite analysts’ warnings. It is unquestionable that nothing notable of significance and value-addition has happened at the company, making it defy the rules of the trade. However, the power of social media and sentiment became the fuel behind this unprecedented drive.

The rules of the game of trade are fundamentals. A stock having a strong future, management and product make it to the best blue chips over at NYSE, NASDAQ & other global stock exchanges. GameStop however is reinventing its own wheel, unknowingly. The story of GameStop is interesting and dangerous at the same time because what happens when the stock navigates back to the levels it can justify? Retail investors will be crushed, once again. Or on a parallel universe, the price will sustain these levels.

Where are the market watchdogs

Security Exchanges & Commission (SEC) which monitors New York Stock Exchange said in a statement that they are “actively monitoring” the situation.

“Consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants,” the SEC said in a statement Wednesday.

Democratic Senator Elizabeth Warren was the first one to demand action against these manipulation.

Representative Alexandria Ocasio-Cortez, also a New York Democrat, said in a tweet that Wall Street and those posting online have taken a similar approach to the economy and markets.

“Gotta admit it’s really something to see Wall Streeters with a long history of treating our economy as a casino complain about a message board of posters also treating the market as a casino,” she wrote.

What’s next for the stock owners?

It is pertinent to note that the stock at this rally means there are unfinished trade options. There are so much open trade offers that the prices of GameStop isn’t able to stabilize itself to levels. The new owners of the stock which is now priced at $450 can simply hope that the retailer company reinvents itself in this modern era of online world by giving up bricks and mortar business model.

The current valuation of GameStop doesn’t justify its business and operations, thus, making it tough for the stock to retain these levels for a long time. The stock owners, most of who are retailers, should not use this opportunity to gamble their savings and end up eventually losing everything they own. Instead, find solace in whatever pricing they deem fit and take a humble exit from the stock.

Best Buy stock which is far bigger and of a larger industry is struggling to have the market capitalization as much as GameStop’s, which tells you the tale of this short-lived fantasy.

Extinguishing the cold fire

This doesn’t mean though that you should buy the stock. The stocks which are driven by sentimental value or through social media buzz, don’t have any fundamentals to stabilize at the levels.

Moreover, this also doesn’t mean that the hedge funds which are losing millions today, will recover soon. The time around, things have been different and the circumstances have now forced companies like Melvin Capital & Citron to square off their positions if they already haven’t.

GameStop posted a negative growth in the last fiscal and is still valued at $24 billions, which calls for a dearly, or rather a terrible fall to come in a few days. Behold!