Esports organization FaZe Clan has been served with a deficiency notice from the Nasdaq stock exchange due to their share price remaining below $1 for over 30 consecutive business days. The notice means that the company now has 180 days to regain compliance, with the share price required to recover to over $1 and remain at that price for 10 consecutive trading days.

As of March 24, FaZe stock had closed below the $1 minimum for 32 trading days, excluding weekends and national holidays. The notice from Nasdaq was received on March 23, informing FaZe that their common stock “failed to comply with the $1 minimum bid price required for continued listing on The Nasdaq Capital Market” for 30 consecutive business days.

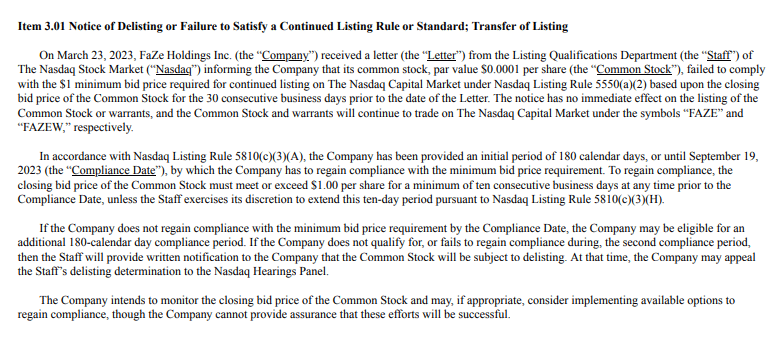

The company has until September 19, 2023, to regain compliance with the minimum bid price requirement, as outlined in a March 24 SEC filing. The filing states that “to regain compliance, the closing bid price of the Common Stock must meet or exceed $1.00 per share for a minimum of ten consecutive business days.”

As of March 24, the closing price of FaZe Clan’s stock sits at $0.67, a significant drop from its all-time peak of over $20 per share in August 2022. If FaZe fails to recover the stock price within the 180-day period, they may qualify for an additional 180-day period. If not, they will be subject to delisting, although they can appeal to the Nasdaq hearing’s panel.

The SEC filing also notes that FaZe “cannot provide assurance that these efforts [to regain compliance] will be successful.” This news comes at a time when FaZe Clan is reportedly exploring options to take the company back private, less than a year after going public. The move was said to be necessary for “financial discipline,” as the company has laid off staff amid the ongoing challenges of the esports and gaming industry.

Moreover, FaZe has been facing internal battles as a handful of original members have spoken out against the organization’s treatment of them. FaZe Clan has responded to these allegations, stating that they know “we haven’t been the FaZe we need to be, but we’re working hard towards fixing that.”

The future of FaZe Clan on the stock market is uncertain, with the organization facing the possibility of delisting if they fail to recover its share price within the allotted time frame. Despite the company’s efforts to regain compliance, there is no guarantee that they will be successful, and the recent news of their exploration of going private suggests that FaZe may be considering alternative options.